Join Our Telegram channel to stay up to date on breaking news coverage

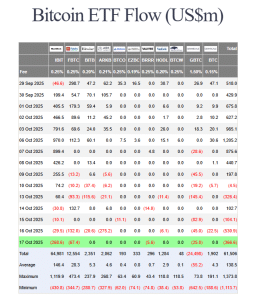

US spot Bitcoin ETFs (exchange-traded funds) recorded $366.6 million in outflows on Friday, extending their losing streak to a third day as investors turned risk-off amid renewed concerns over stress in credit markets

The withdrawals followed $536 million in outflows a day earlier, the largest single-day net loss since August, amid weakening appetite for risk assets as jitters about US regional banks rippled through markets.

That sent Bitcoin plunging to as low as $103,598.43 in the past 24 hours, according to CoinMarketCap. It has since recovered to trade at $106,586.89 as of 12:41 a.m. EST, still down over 2%.

The Crypto Fear & Greed Index, a gauge of investor sentiment, has plunged 29 points from last month to an ”extreme fear” reading of 23.

BlackRock’s IBIT Leads The Spot Bitcoin ETF Outflows

IBIT, the Bitcoin ETF offered by asset management giant BlackRock, recorded the highest net daily outflows on the day. Data from Farside Investors shows that $268.6 million exited the product in the latest trading session.

IBIT is still the leader in terms of net cumulative inflows since the products launched last year, with $64.981 billion entering the fund since then.

US Bitcoin ETF flows (Source: Farside Investors)

Fidelity’s FBTC saw the second-biggest outflows yesterday of $67.4 million. Meanwhile, Valkyrie’s BRRR and Grayscale’s GBTC experienced $5.6 million and $25 million outflows, respectively.

The remaining funds recorded no new flows on the day.

With the latest net daily outflows, the funds have now seen over $1 billion outflows over the past three days.

Michael Saylor Says Volatility Is A Gift

As Bitcoin’s price slides, Strategy’s Michael Saylor says that volatility in the crypto market “is a gift to the faithful.”

Volatility is a gift to the faithful.

— Michael Saylor (@saylor) October 17, 2025

Strategy is currently the largest corporate holder of Bitcoin, with 640,250 BTC on its balance sheet.

The company started buying BTC in 2020, and ended up pioneering the digital asset treasury (DAT) firm trend. SaylorTracker data also shows that Strategy is sitting on an unrealized profit of more than $20.9 billion on its balance sheet, even after the latest correction in Bitcoin’s price.

Meanwhile, analyst Michael van de Poppe commented on the latest Bitcoin price drop and the correction seen in the overall crypto market. In an X post to his over 811.9K followers, the analyst said that there is not much to worry about.

There’s not much to worry.

The only thing you should do, as an holder of your assets, is to be patient.

The 4-year cycle theory is dead. #Bitcoin would never be $100k+ if it wasn’t without the ETFs.

That means, that we’re still in the same shape.#Bitcoin breaking up from…

— Michaël van de Poppe (@CryptoMichNL) October 17, 2025

He told his 811k followers that there’s ”not much to worry” and urged them to just “be patient.”

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage